Everyone thinks meal subscription boxes such as HelloFresh, Blue Apron, EveryPlate, and the like are the future of food because they show up at your door labeled “fresh” with cute packaging. But the math behind these services is not sunshine and roses. It is a constant game of margins, retention, and logistics that most founders do not tell you about.

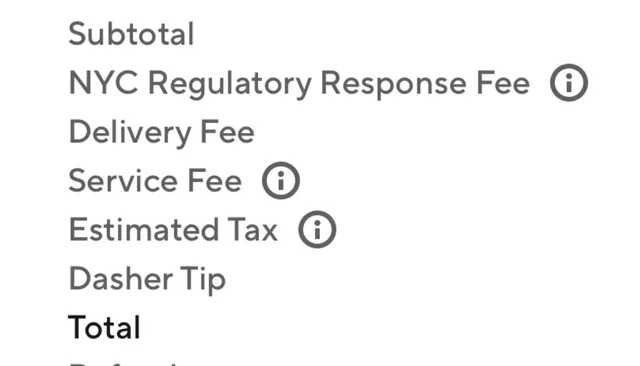

First, the costs scale fast. Ingredients alone usually eat up about 25% to 35% of total revenue before you even hit the packing table. Food is expensive. Packaging, transportation, labor, and marketing add another layer that surprises a lot of people before they even think about profit.

Then comes the real kicker that most people do not see until later. Customer Acquisition Costs (CAC) are high. Meal kit companies spend big on ads, discounts, influencers, SEO, and referral deals to get subscribers initially, often between $80 and $150 just to sign up one customer. That is before the first box lands on a stoop.

Even if the gross margins look decent, with many subscription boxes aiming for 40% to 60% at the top level because of the recurring nature of sales, the net margins shrink fast once all of the overhead gets applied. Real life numbers show meal kit services often squeeze into tight 5 to 10% net profitability after expenses. That is not a buffet; that is a tasting menu with tiny portions.

And here is the part that never gets talked about outside investor decks. Churn is brutal. As soon as you get someone to subscribe, most services lose the majority of them within the first year unless they constantly re-incentivize renewals. In some analyses, industry veterans claim up to 90% of subscribers cancel within months if the experience is not sticky.

That means brands have to repeatedly pay big CAC just to keep revenue stable. You are not just selling meals; you are selling membership every single billing cycle. If you screw up a delivery, a recipe, or the price feels off, goodbye subscriber.

Even the market size numbers tell a story of future growth paired with serious pressure. The global meal kit market is projected to grow strongly over the next decade, hitting something like $76 billion by 2034. But growth projections do not equate to pockets of profit for operators today. They are mostly valuations that assume consolidation, scale, or some exit event.

On the consumer side, it is also worth noticing how expensive these kits can be compared to groceries. Most meal kit servings land somewhere between $7 and $14 per person, cheaper than most restaurant meals but often more than buying ingredients yourself at a supermarket. For the business, that price has to absorb food cost, shipping, packing, labor, marketing, and still leave something for profit.

Startups try to offset this by boosting retention. Subscriptions, tiers, community perks, and upsell offers matter because recurring revenue is the magic trick in subscription models. In theory, once someone stays subscribed longer than their CAC payback period, they become profitable. But the reality is most meal subscription operators are chasing that holy grail of lifetime value being three times the cost to acquire a customer, a number that is harder to hit than it sounds.

Meal kits can work. Some operators slice their food costs carefully, negotiate bulk pricing, streamline fulfillment, and hold on to subscribers long enough to amortize that enormous CAC investment. But if you are imagining easy margins and predictable recurring income, the real math says this business is more like a treadmill than a revenue machine. It is constantly moving, constantly expensive, and very hard to stop without losing ground.

For consumers, knowing this explains why prices feel high even with discount codes. For operators, it explains why so many brands burn through cash getting early traction and pivot into different models such as ready-to-eat meals when the subscription churn hits. It is a game of thin margins, steep acquisition costs, and retention pressure, not just pretty boxes and recipe cards.

Like this? Explore more from: